Expert Tips on Obtaining Approved for a Secured Credit Card Singapore

Expert Tips on Obtaining Approved for a Secured Credit Card Singapore

Blog Article

Charting the Path: Opportunities for Charge Card Accessibility After Insolvency Discharge

Browsing the world of debt card gain access to post-bankruptcy discharge can be a difficult task for people looking to reconstruct their monetary standing. From safeguarded credit report cards as a tipping stone to prospective courses leading to unsafe credit scores chances, the trip towards re-establishing credit reliability requires mindful factor to consider and notified decision-making.

Recognizing Credit Report Fundamentals

Comprehending the fundamental principles of credit report is crucial for people seeking to browse the complexities of financial decision-making post-bankruptcy discharge. A credit report is a numerical representation of an individual's credit reliability, indicating to lenders the level of risk associated with prolonging credit score. A number of factors add to the estimation of a credit report, consisting of repayment background, amounts owed, size of credit report, new credit score, and kinds of credit used. Settlement history holds significant weight in identifying a credit history, as it shows a person's capability to make timely repayments on arrearages. The quantity owed about readily available credit rating, also referred to as credit rating usage, is another crucial variable influencing credit report. Furthermore, the size of debt background showcases an individual's experience taking care of debt in time. Recognizing these essential parts of credit history equips individuals to make enlightened financial choices, rebuild their credit history post-bankruptcy, and job in the direction of attaining a much healthier economic future.

Guaranteed Credit History Cards Explained

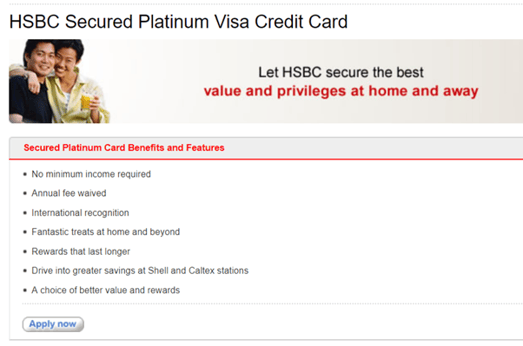

Safe charge card provide a valuable economic device for individuals looking to reconstruct their credit report adhering to an insolvency discharge. These cards require a protection down payment, which generally establishes the credit line. By utilizing a protected charge card properly, cardholders can show their credit reliability to prospective lending institutions and progressively enhance their credit report.

One of the key advantages of safeguarded credit cards is that they are a lot more accessible to individuals with a minimal credit report or a tarnished credit history - secured credit card singapore. Since the credit score restriction is protected by a deposit, issuers are extra happy to authorize applicants who might not qualify for traditional unsecured credit report cards

Charge Card Options for Rebuilding

When seeking to reconstruct credit after insolvency, checking out various credit rating card options tailored to individuals in this financial scenario can be beneficial. Secured credit cards are a preferred option for those looking to reconstruct their credit rating. An additional choice is coming to be an accredited user on someone else's credit card, allowing people to piggyback off their credit background and possibly increase their own rating.

Just How to Receive Unsecured Cards

Checking credit records consistently for any mistakes and disputing inaccuracies can additionally improve credit ratings, making people more appealing to credit report card issuers. Additionally, people can think about using for a safeguarded credit report card to restore credit scores. Safe credit history cards require a cash money deposit as collateral, which lowers the danger for the issuer and enables people to demonstrate accountable credit scores card use.

Tips for Liable Bank Card Usage

Building on the structure of improved creditworthiness established through accountable financial management, people can enhance their overall financial health by applying key pointers for accountable charge card usage. To start with, it is vital to pay the complete statement equilibrium on schedule each month to stay clear of collecting high-interest charges. Setting up automated payments or tips can assist guarantee prompt settlements. Secondly, keeping track of costs by regularly keeping an eye on bank card declarations can protect against overspending and aid recognize Learn More any kind of unauthorized purchases immediately. Additionally, maintaining a low debt utilization proportion, preferably below 30%, demonstrates accountable credit report use and can positively impact credit rating ratings. Preventing cash loan, which typically include high charges and rate of interest, is likewise suggested. Finally, avoiding from opening several brand-new debt card accounts within a short period can protect against potential credit rating damages and excessive financial obligation buildup. By sticking to these pointers, people can utilize credit cards properly to restore their financial standing post-bankruptcy.

Final Thought

In final thought, people who have declared personal bankruptcy can still access bank card via numerous options such as protected charge card and restoring credit score (secured credit card singapore). By understanding credit scores rating basics, certifying for unsafe cards, and practicing responsible bank card usage, individuals can gradually restore their credit reliability. It is crucial for individuals to very carefully consider their economic circumstance and make informed choices to improve their credit scores standing after bankruptcy discharge

A number of factors contribute to the estimation of a credit rating, consisting of payment background, amounts owed, size of debt background, brand-new credit report, and kinds of credit score made use of. The quantity owed relative to readily available credit, likewise known as credit history application, is another vital factor affecting credit report scores. Keeping track of credit history reports on a regular basis for any type of mistakes and contesting errors can further enhance credit rating scores, making people much more attractive to credit card issuers. In addition, maintaining a reduced credit history application proportion, preferably listed below 30%, shows accountable credit rating use and can favorably affect debt scores.In final thought, people that have submitted for personal bankruptcy can still access credit score cards through different options such as protected credit history cards and reconstructing credit rating.

Report this page